Why bootstrap?

The world of technology business nowadays is dominated by VC-funded startups. The majority of tech news is about who raised another record round of funding. There is a cascading effect of this being perceived as the default way of building a software business.

Step one is getting into a reputable startup accelerator. Step two is a seed round. Step three is VC funding (usually several rounds). Step four is selling the company or (if you are very lucky) IPO.

At Whimsical, after some contemplation, we’ve decided to pursue a more traditional way of starting a business. Step one is building a product that at least some people would pay for. Step two is reaching profitability. Step three is to keep growing in a balanced way. And that’s about it.

In no particular order, here’s a list of reasons why we picked this path.

We don’t want to constrain ourselves with a need to “exit”. The classic funding model for startups is based on the potential of selling the startup’s shares in future, an event referred to as the “exit”. The ultimate exit for a company is going public but very few companies ever get to the scale needed for that. Selling the whole company is a more likely scenario but it has major downsides:

- The whole process of selling the company is stressful, risky, and costly if it falls through.

- You lose control over the future of the product. The chances of it being axed are high. Often the buyer is only interested in the team, the technology, or the customer base. Even if it’s not the case upfront, the priorities may shift over time.

- The buyer will want to integrate the technology and team into its own organization. It is an unpredictable process that can lead to the original team disintegrating and the product going downhill fast.

- It almost never benefits the customers.

After having gone through the process twice, I have a strong preference for not having to do it again. Even if that wasn’t the case, we intend to build a company that we never need to or want to sell. I’m 40. I love what we are working on and as far as I can see, there is nothing else I would rather do for the rest of my life.

We don’t want to grow at all costs. The math of VC funding implies that it’s all about big winners and the majority of the companies they invest in do not matter in the end. So it’s only natural that VCs advise and expect companies to maximize their growth potential. The downside is that it can push some companies over the edge when they could have thrived growing more slowly.

Even when the company doesn’t crash, a growth-above-all mentality can be unhealthy. It cultivates a highly data-driven decision culture, and pushes aside more qualitative aspects of decision making, such as moral beliefs, cultural impact, mission, and so on.

Another common trap is that because of the pressure to grow, companies end up hiring faster than the culture and structures can absorb. It’s also too easy to hire more people than the company really needs. In the worst case, people get laid off. It all ends up damaging the culture and morale.

On the other hand, bootstrapping affords us the opportunity to grow in a more balanced way. We have strong moral principles and a mission that is more important than improving any single metric. We prefer to take our time with growing the team and would rather slow down than add people faster than we feel comfortable.

The risk profiles for founders and VCs are not symmetric. Startup founders invest years of their lives in the company. There’s zero diversification for them. It’s very different for VCs who have a portfolio of companies. This means that pushing founders to take bigger risks isn’t particularly risky to VCs. Such asymmetry can lead to lasting conflicts that don’t exist in bootstrapped companies.

(To be fair, it’s not uncommon for company founders to diversify by selling some of their stock to VCs. Although it usually happens in the latter stages and many companies don’t ever get there.)

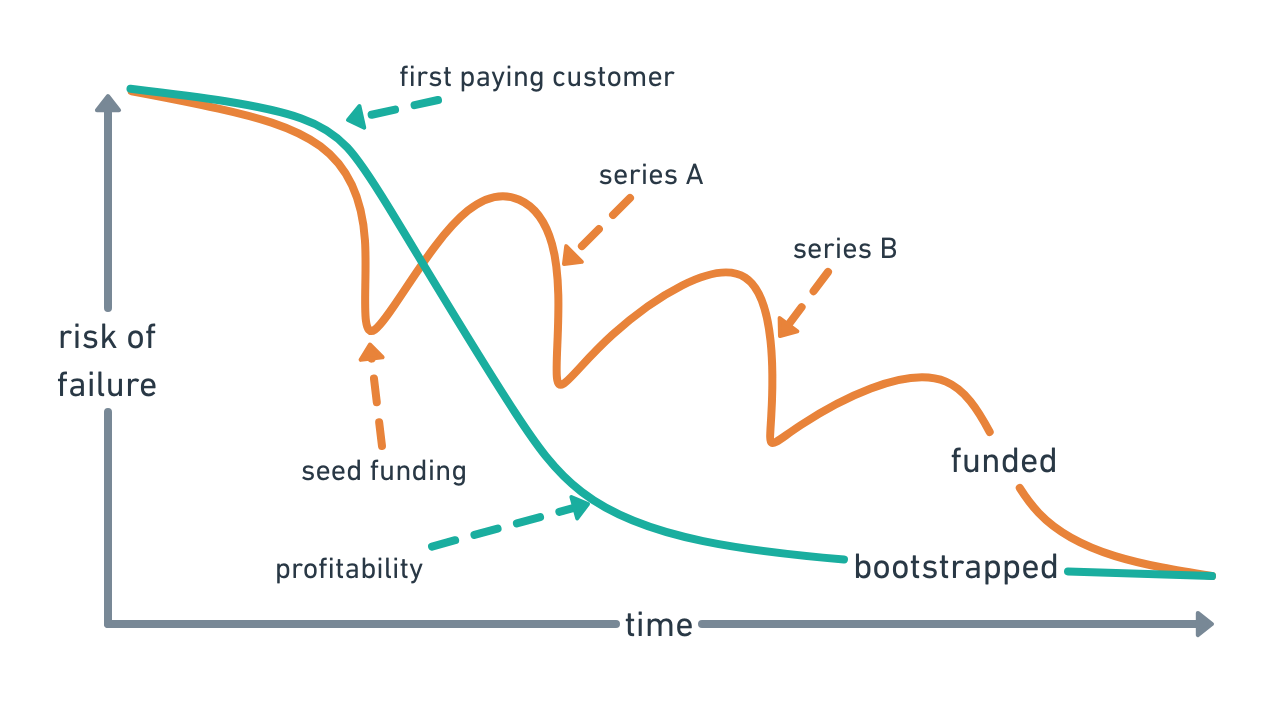

Overall risk of failure of a bootstrapped company is lower. Bootstrapped businesses are not easy to get started. It can take a significant amount of time to get to enough recurring revenue to become sustainable.

The upside of bootstrapping is that once you are profitable, the risk goes way down. Since funded startups are under pressure to maximize growth, profitability takes a back seat. Without profitability, the company remains vulnerable.

False dichotomy of a lifestyle versus VC-backed businesses. There is this popular notion that if you build a tech business, it’s either VC-backed or it’s a lifestyle business. We don’t subscribe to that. We are building a real business as ambitious as a typical VC-backed company. Whether we raise outside funding or not is just an attribute. It does not define us.

We want to minimize the risk that our product will disappear in a few years. Nobody wants a product that they rely on daily to vanish. But that unfortunately happens all the time. Remember Sunrise? Or Mailbox? Or Smyte?

As described earlier, the dynamics of VC-funded startups make such an outcome quite likely. At Whimsical we want to build a lasting product. Something that you can trust and rely on for many years to come.